The long awaited growth in the tech sector is back, but still shaky

Tech services are showing signs of growth, despite the sluggish Accenture results. However, growth rebound will not be secular. Specific sectors, technologies and customer segments will lead the way.

I spent more than a decade working in technology — as a product developer 💻 in my first avatar, before it was a thing, and then consulting for technology services firms. Over these years of scouring the web, I found little content on technology services. This is a trillion dollar 💲 industry that provides thousands of jobs and creates wealth for its talent.

But no one writes about this. Not consistently and clearly at least.

Welcome to TechScape.

I write about the latest and greatest 👑 in the world of technology services companies — digging into the opportunities ✅ and challenges ⛔ that tech services leaders are facing or likely to encounter.

I write based on my working experience ⚒ in this sector and synthesis of my copious reading 📖 that I do as part of my work.

Good afternoon,

Hope you guys had a good weekend. As I was thinking of writing this piece today, and it is a longer read than my usual posts, two burning topics came to mind. In my work and discourse on tech services, I most constantly encounter the two ‘G’s -

The unmistakable GenAI

The elusive Growth

GenAI needs dedicated space and time, I am planning a deep dive into GenAI, mostly on the softening of the hype, but that’s for later. For a quick look, I exchanged a few notes with

on Notes → Read them here.Unlike GenAI, growth is an evergreen topic, and with the sluggish growth over the last two years, this becomes an important point in time to discuss it. So today we will cover it in detail, uncover if the estimated growth is back or still elusive.

So let’s get to it.

—

Let’s look at the bloodbath since 2022

If you follow my Substack or the tech sector broadly, you would know the technology sector, and by extension, the technology services firms have bled in the last two years. This hammering is a confluence of multiple cataclysmic events at play, all played out in beautiful harmony, almost as if Amadeus coordinated it, taking the world by storm —

After 80 years, Europe was gripped by war. With Russia invading Ukraine, and a renewed conflict between Israel, a major tech startup hub, and Palestine, geopolitical conflicts escalated to an unseen level. The already debilitating trade war between the US & China, the two largest economies, paled in comparison

The war resulted in a strained supply of fuel, critical for homes and industries, which kicked up inflation into double digits (peaked at 10% in the US, and UK). To counter the unprecedented double-digit inflation the Fed, Bank of England and ECB increased interest rates at a pace and to a level that was unseen in recent history, which inevitably cramped business investments.

On top of the geopolitics-induced macroeconomic crisis, the COVID-led surge in digital investment had subsided. Understandably so. Businesses lost the momentum and impetus to make investments at the same rate. As a result, technology spending plummeted abruptly

Impending elections in key countries like the US, the UK, and India slowed business investments as most waited to see the new direction from the newly elected governments

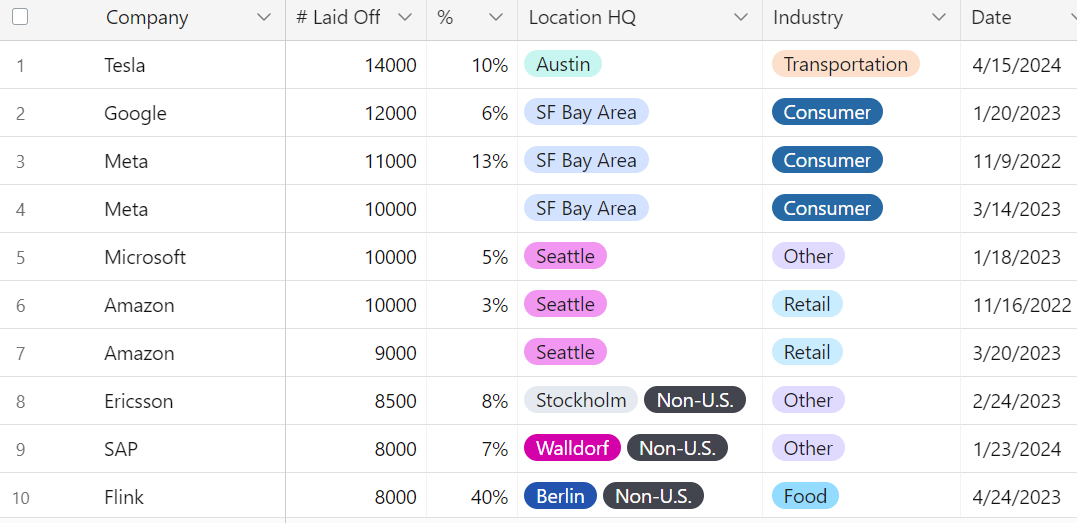

Consequently, technology services firms had near-zero growth as clients shuttered their IT and digital spending. In light of this unexpected and severe downturn, most firms resorted to layoffs to protect the business. Layoffs.fyi, a firm that tracks layoffs, reported a total of 165,000 job losses in 2022. While this is large, it pales in comparison to what came a year later. A whooping 263,000 job losses in 2023. Not surprisingly, leading the pack were tech companies — Meta (21,000), Amazon (19,000), Tesla (14,000), Google (12,000), Microsoft (10,000).

In the rush to cut costs some firms, notably Google, fired new and tenured employees in a manner that only be described as ruthless and indiscriminate. People were fired with a moment’s notice or even abruptly as they were logged out of their company systems, and office access cards stopped working one fine morning. More than the reputational damage, at some level this altered the modern generation’s outlook towards work. “Live life, not work”, “Work is not family, don’t treat it like one” became the grounding thoughts amongst the workforce.

Earlier this year when I switched over to writing on Substack, the time was opportune to write about the imminent and much-needed growth of the technology services firms. In the first half of 2024, the business sentiment had started to turn. Inflation in the US, UK and EU had started to cool bringing hope of an imminent interest rate cut to stimulate the economy. Elections in major economies such as India and the UK were conducted, thus settling the uncertainty of political direction. Hope for the elusive growth, it seemed, was around the corner.

As a result, my second and third posts on Substack were on the impending growth of technology services firms — when will it come? Which sectors and technologies will see growth? Which firms are best positioned to capture it?

Now that we are into H2 of 2024 and with most firms starting to report results till May/June 2024 including the estimates for growth for this year, it is a good time to evaluate if growth has come back. Short answer — Yes but it is still on shaky ground.

Hopes of imminent growth are quashed

Accenture, the IT bellwether, is considered the trendsetter in this industry. It has the broadest portfolio of services -- consulting, technology design, managed IT services, and business process operations. One of its biggest competitive advantages is its strong consulting arm which helps differentiate itself from the traditional IT services providers and helps win large and strategic deals. But when Accenture reported its quarterly results (Feb-May’24 results), it was tepid. As a shock, the consulting business contracted by 1%, possibly for the first time ever, and only the managed services grew by 4%.

While the industry consensus was a 5% revenue growth, Accenture reported a sluggish 1.8% YoY growth. Just after the results were announced on 20 June, Accenture stock dipped sharply reflecting the disappointment of investors of a rebound in growth in 2024-25.

The hopes of a tech spending rebound and growth of the service firms fell. Despite strong indicators of growth, this news sent shockwaves through the tech services world. Stock prices plummeted, and analysts cast doubts on the growth prospects of other big and small tech services firms.

Silver lining at last

Come July 2024, a whole host of tech services firms, mostly Indian firms such as TCS, Infosys, HCL, announced their Apr-Jun’24 quarterly earnings. TCS, HCL are the first to report, followed by Infosys and others. So far, while the results have been a mixed bag, they are nowhere close to the catastrophe predicted in the aftermath of Accenture’s results, which was an incredible aberration.

Let’s look at the big boys — TCS, Infosys, Wipro and HCL — combined to make $72Bn in revenue and $360Bn in market cap.

The biggies have shown healthy revenue and profit growth except Wipro, which had yet another disappointing quarter. Ignoring Wipro’s performance, as it has been a historical laggard. By that account, the biggies have done better than street expectations.

TCS, the $29 Bn behemoth, reported results better than the market expectations, with a 5.5% YoY revenue growth and a staggering 8.3% YoY profit growth.

Infosys, the next biggie with $18 Bn revenue, had a sluggish 3.4% revenue growth.

HCL, with $13Bn in revenue, delivered a 6.7% revenue growth and a mouth-watering 20% increase in net profit. However, HCL projects a weak FY25 with 3%-5% revenue growth.

The ugly duckling is Wipro. Revenue declined year on year by 3.8% and unsurprisingly the stock price dropped by 7% in a single day. But Wipro’s poor showing is more of an internal problem than an industry issue.

On the other hand, the mid-tier firms have been the darlings of the tech services world. The likes of Persistent, LTIMindtree, Tata Elxsi, Coforge — firms with revenue less than $2 Bn revenue but growing at high double digits.

Cautious optimism at play

Despite the growth momentum leading up to June 2024, the future is not all rosy. The biggest growth lever, one might consider that as utopic, GenAI has not delivered on growth yet. Mega billion dollar investments have poured in but growth is elusive. Earlier this year, Accenture committed to a $3 Bn investment in GenAI and reported securing a staggering $2Bn of GenAI deals. But when I see Accenture’s revenue growth figures, there is a hole. There are plenty of reasons on which I have written a few Notes, but the details require a separate post.

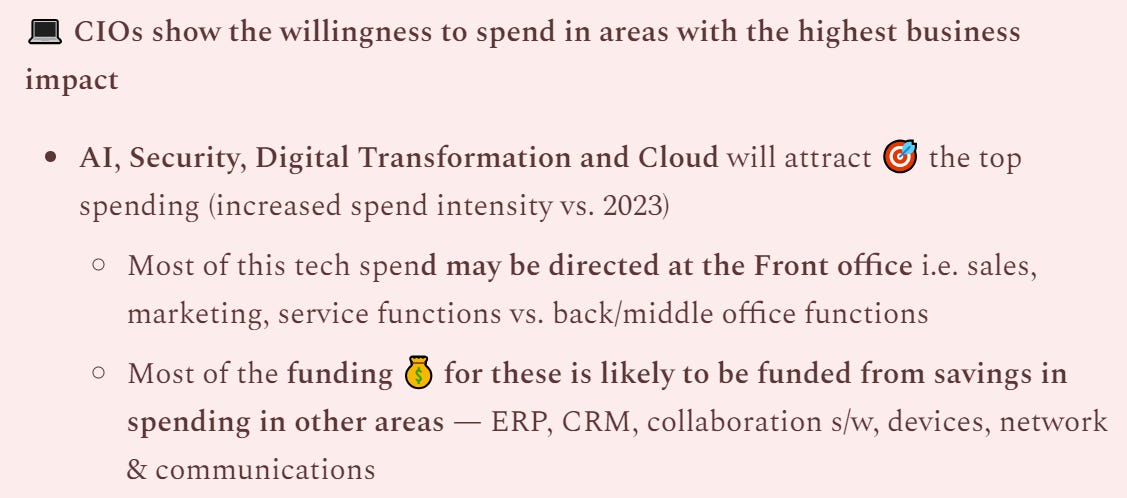

What’s the second-order impact of the softening of the GenAI? As we know the high interest rates persist which implies new funding will be hard to come by. With the initial investment in GenAI sunk, CIOs/CTOs leaders can only fund new programs that are strategic e.g. Cybersec, and too by extracting savings out of non-critical, possibly legacy, programs. There are a few CIO spending reports that corroborate this point.

If I look at the demand profile across verticals, then the rebound in growth will not be secular. Sectors such as Retail, and Consumer have been resilient in the face of high interest rates (in the US) and are expected to drive demand. On the other hand, Banking will not show a quick rebound, especially after being hit by the SVB crisis.

The rebound in growth is being closely watched by industry leaders. Given the unevenness of the rebound, tech services firms are likely to see a different growth path and set of challenges in the upcoming 12-18 months. The maturing of GenAI or its alternative will either change the shape of the tech services business or catch the leaders in yet another hype-led spending spree.

Either way, change is afoot and that makes 2024-25 a nail-biting year to watch.